Content

However, once the swap has its asset fixings its mark-to-market value also depends on the current asset price. Warrants are also referred to as in-the-money or out-of-the-money, depending on where the current asset price is in relation to the warrant’s exercise price. The company’s https://online-accounting.net/ current asset level is up from $2.9 billion at the start of the year. Liquidity ratios provide important insights into the financial health of a company. Accounts receivables are any amount of money customers owe for purchases of goods or services made on credit.

What are 10 current assets?

- Cash.

- Cash equivalents.

- Short-term deposits.

- Accounts receivables.

- Inventory.

- Marketable securities.

- Office supplies.

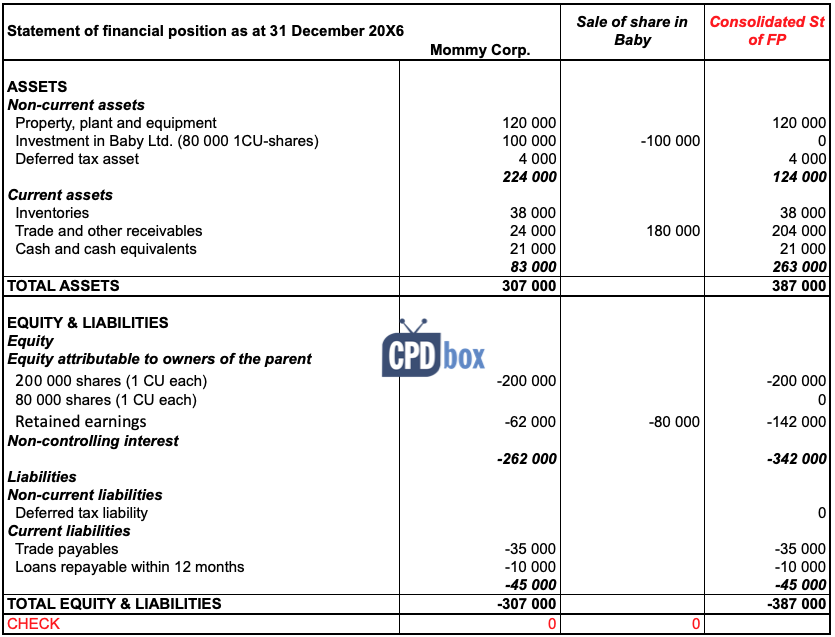

Non-current assets are longer-term assets with a full value that you cannot recognize until after one year, such as property and machinery. Non-current assets can be both “tangible” and “intangible”, that is, things you can physically see and touch as well as resources that do not have a physical form. Current assets are categorized as “liquid” or “more liquid” depending on how quickly you can convert them into cash. In addition, What is a current asset? the resource allocation function is concerned with intangible assets such as goodwill, patents, workers, and brand names. The current ratio is calculated by dividing total current assets by total current liabilities. It is frequently used as an indicator of a company’s liquidity, which is its ability to meet short-term obligations. The difference between current assets and current liability is referred to as trade working capital.

Marketable Securities

If current assets are those which can be converted to cash within one year, non-current assets are those which cannot be converted within one year. On a balance sheet, you might find some of the same asset accounts under Current Assets and Non-Current Assets.

- Current assets are generally reported on the balance sheet at their current or market price.

- They may extend this to looking at non-current assets and non-current liabilities to get an idea of a company’s future prospects.

- Asset management enables you to detect when items disappear and prevent loss in the first instance.

In the case of auction-rate securities, the failure rate was exceedingly high, and the use of auction-rate securities as a current asset significantly declined. What is the proper amount of cash a company should keep on its balance sheet?

Inventory Stock

The goal of rebalancing is to move the current asset allocation back in line to the originally planned asset allocation (i.e., their preferred level of risk exposure). You can explore these principles in much greater detail on ourtwo-day financial statement analysis course, which takes place virtually. When the working capital is managed well, it can help the business increase its profits, value appreciation, and liquidity. Managing working capital is vital for business growth and helps avoid cash flow problems. Louis DeNicola is the president of LD Money Media LLC and an experienced writer who specializes in consumer credit, personal finance, and small-business finance. He is a Nav-certified credit and lending specialist, a multi-year attendee of an 18-hour advanced credit education seminar, and a volunteer tax preparer through the IRS’s VITA program.